Enhance your forex trading with our free forex signals. Get reliable trading signals as trade ideas tailored for forex traders, helping you navigate the forex market with expert insights.

To succeed in the Forex market, Forex traders should analyze trends, develop personalized strategies, and continuously educate themselves. Relying solely on Forex trading signals isn’t enough; informed decision-making and adaptive learning are crucial.

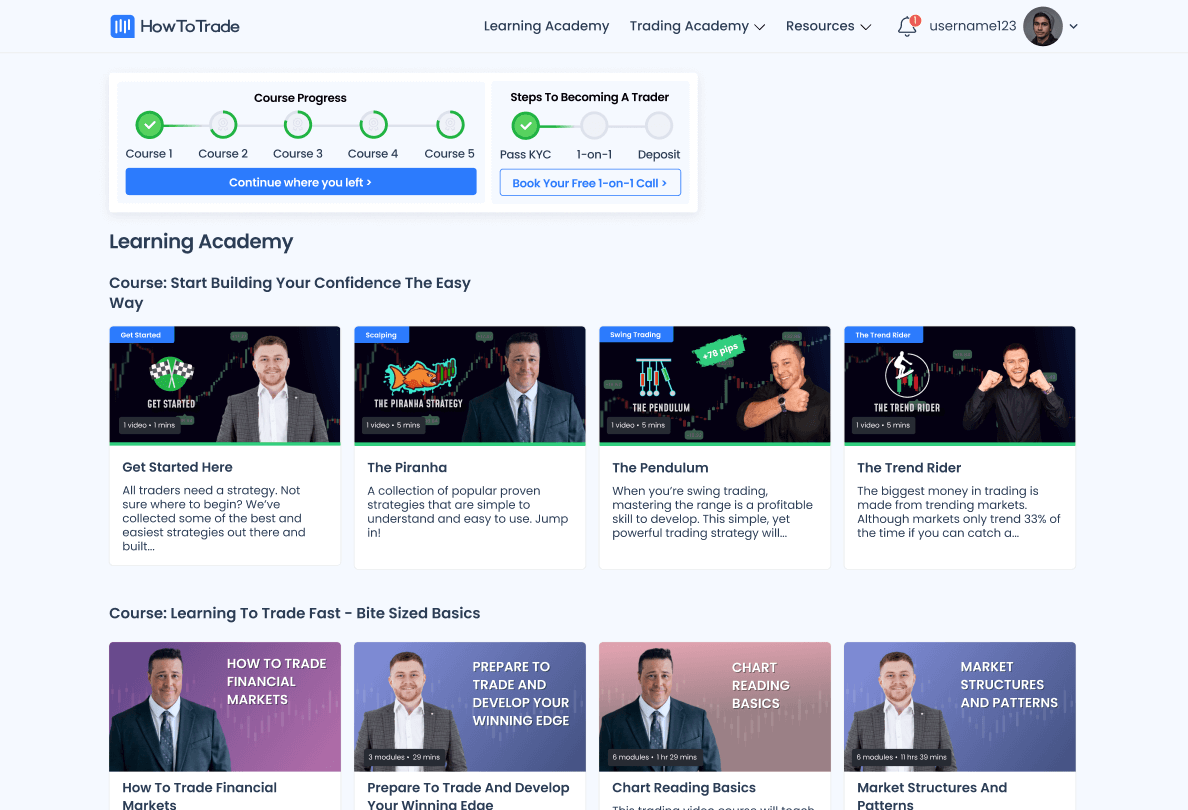

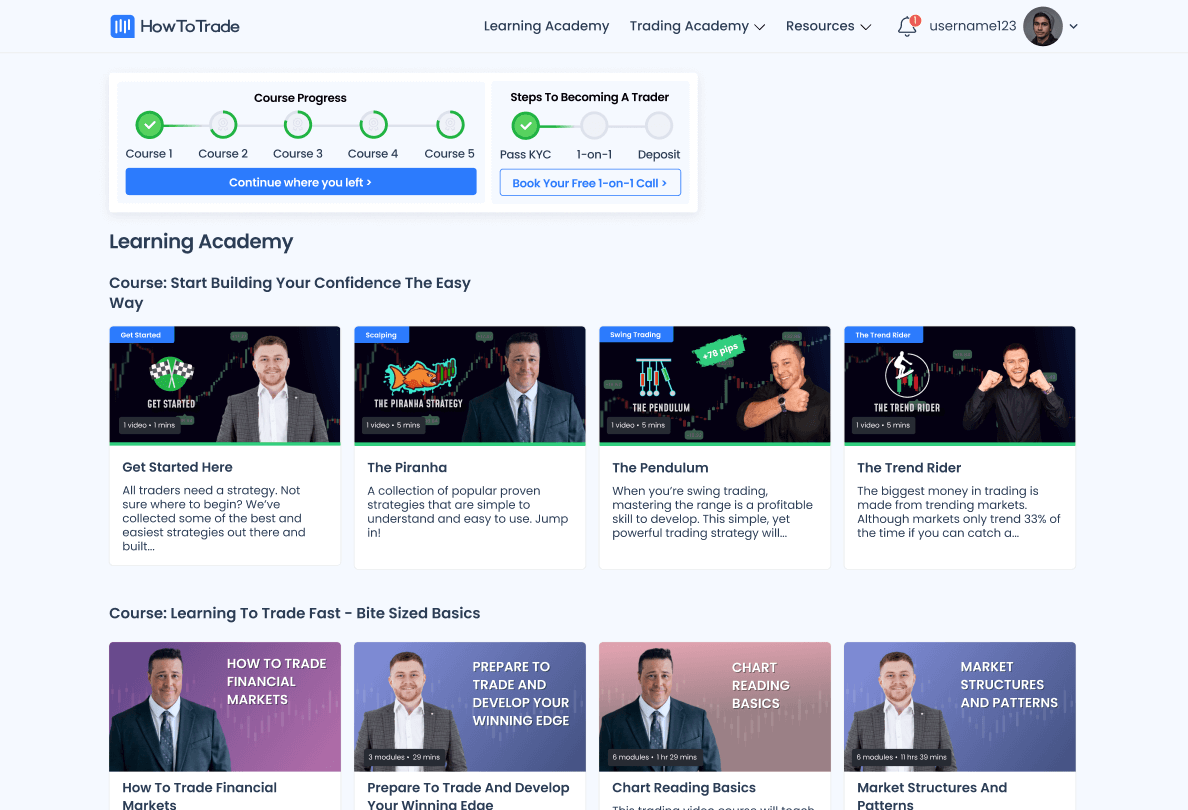

Visit our free trading academy and stay up to date with trading education.

Visit The Trading AcademyCheck our live trading streams by our experienced market analysts.

Check Our Live StreamsUse our trading tools to analyze currency pairs beyond Forex signals.

Check Our Trading Tools

Forex trading signals are not enough! Knowledge is everything, the more you know, the better your trading game will be. Our free Trading Academy is packed with world-class trading education.

No credit card required.

Tune in to the daily live streams to watch our experienced trading analysts discuss the Forex markets. Watch them at what they do best and learn how to analyze the financial markets like them.

Next LIVE stream starts in:

Switch Markets Live!

by Shain Vernier

No credit card required.

Our market analysts are far more than just analysts; they are experienced traders with years of proven track record and mentoring experience. From trading Stocks, Forex, and Commodities to keeping you updated with the latest market trends, we are here to guide you through the trading week. They’ve chalked up countless wins and losses, all in the pursuit of profit.

Gain instant trading insights with our swift, 2-minute strategies. Designed for immediate success, these expert guides streamline your path to trading mastery.

No credit card required.

Forex signals are trade recommendations or alerts provided to traders about potential trading opportunities in the foreign exchange (Forex) market. Professional analysts can generate these signals manually or automatically by trading algorithms and systems.

Forex signals assist traders in making informed trading decisions, potentially increasing their chances of making profitable trades.

They typically include crucial information such as:

Currency Pair: The specific currencies involved in the trade (e.g., EUR/USD, GBP/JPY).

Action: Whether to buy or sell the currency pair.

Entry Point: The suggested price level to enter the trade.

Stop-Loss Level: A price level to close the trade to prevent further losses.

Take-Profit Level: A price level to close the trade to lock in profits.

Time Frame: The recommended duration to hold the trade (e.g., short-term, long-term).

Forex signals work by providing traders with actionable trade recommendations based on various analysis methods. Here is an overview of how they typically function:

Some traders see Forex signals as an opportunity for efficient and informative trading. Their strategy is to rely on signals from sources they think they can trust.

Types of Forex Signals

There are several Forex signals, categorized based on how they are generated, the methods used, and the specific focus of the signals. Here are the main types:

1. Based on Generation Method:

2. Based on Analysis Method:

3. Based on Trading Style:

4. Based on Risk and Reward Profile:

5. Based on Source:

Each type of Forex signal has its unique characteristics, benefits, and potential drawbacks. Traders can choose the type that best aligns with their trading style, risk tolerance, and market outlook.

The truth is — no one knows. Using signals is the personal choice of a trader who cheated his strategy. Of course, some signal providers have better performance reviews than others but remember that even the best traders have ups and downs.

The duration of a Forex signal can vary significantly depending on the type of signal and the trading strategy it is based on. Scalping signals last a few seconds. Day trading signals can last from minutes to the entire trading day. Swing trading signals can last for weeks and position trading signals can last for years.

In the end, the duration of the signal depends on trading strategy and market conditions.

Choosing the right Forex signals provider involves thorough research and due diligence. Prioritize providers with a proven track record, transparency, and a strong reputation. Align their services with your trading style and risk tolerance to maximize your chances of success.

Integrating Forex signals into your trading strategy involves a structured approach to ensure they enhance your trading performance rather than complicate it.

Practical Steps to Integrate Forex Signals:

No! Only research, a deep understanding of how the signal works, market understanding and some luck may return you in profit. Always research and remember that the Forex market is a high-risk place.

Please treat forex signals seriously and with respect, as any financial instrument deserves.

The main metrics in forex signals are transparency, performance review, and signals provider experience. Payment is not the one.

Some people use them irresponsibly. And like any financial instrument in the wrong hands, signals can be a source of trouble. Only informed, educated, and motivated traders can use signals for their benefit. Otherwise, this is no better than gambling.

ForexSignals.com is merging with HowToTrade to provide a more comprehensive educational experience.HowToTrade focuses on education rather than solely providing explicit trading signals. You will learn to develop and implement your strategies, which we feel is a more sustainable approach to trading. Please pay attention to the trade ideas and market analysis sections, as we will continue to share our thoughts on market consensus. Also, HowToTrade has a lot of day-to-day trading instruments for traders with any level of experience.

Subscribe for on-demand lessons, trade ideas, trading challenges and weekly newsletters packed with actionable information.