- Forex position trading is a long-term strategy that involves holding a position for an extended period.

- Popular forex position trading strategies include carry trade, trend trading and range trading.

- Positional trading is an excellent choice for beginner traders who prefer a more relaxed and less time-intensive approach to trading.

Of the four trading styles, position trading is the most long-term method in which traders hold their position for weeks, months, and even years.

Unlike day or swing trading, position trading requires less time and attention to the market, making it ideal for those with busy schedules or those who prefer a more laid-back approach. At the same time, position trading requires higher trading capital and a lot of patience.

So, is it the right trading style for you? And how does one become a successful position trader? Here, we’ll dive into position trading, explore its main strategies, and weigh the pros and cons of this forex strategy. By the end of this guide, you’ll know if the Forex position strategy is the right trading style for you.

Table of Contents

Table of Contents

What is Position Trading in Forex?

Forex position trading is a popular long-term strategy that involves holding a position for an extended period. This can range from a few weeks to several months or even years.

Unlike day trading, scalping, and the swing trading strategy, where traders seek to profit from short-term price fluctuations, position traders focus on capturing long-term trends in financial markets. This allows a position trader to avoid the noise and volatility prevalent in the short term. Also, most position traders don’t have to be glued to the screen daily.

Generally speaking, a position trader typically takes a few long-term positions intending to deliver sustainable gains over the long term. It is the most traditional form of investing, mainly known as a buy-and-hold trading technique (and HODL for crypto traders). Not surprisingly, Some of the richest forex traders in the world have made their fortune using the long-term position trading strategy.

As a forex position trader, you must base your decisions on several fundamental macroeconomic factors, including interest rate projections, economic indicators, political stability, and economic growth. You can also combine technical and fundamental analysis to identify key support and resistance levels, trend lines, and chart patterns.

Of course, position trading can be applied to any asset class, including commodities, stocks, bonds, indices, and cryptocurrencies. Speaking of digital assets, we all heard the stories of those who become rich by holding a Bitcoin position for several years. That’s a great example of position trading, and the logic works the same in the forex market.

How Does Position Trading Work in Forex Trading?

Now that you know what position trading is all about, let’s see how it actually works in forex trading.

As mentioned, position trading requires holding onto trades for a long period, usually longer than weeks. In the forex market, the approach is primarily based on fundamental analysis of economic data, political events, and other factors impacting currency prices. Many forex position traders also use a forex correlation cheat sheet to find the best currency pairs for positional trading.

To start with position trading, you must first choose the currency pair you want to trade and thoroughly analyze its underlying fundamentals, such as the growth domestic product of the currency country (GDP), inflation rates, employment data, and political developments like elections and policy changes. Once you have chosen a currency pair with potential for a long-term trend, you can take a long or short position based on your long-term market outlook.

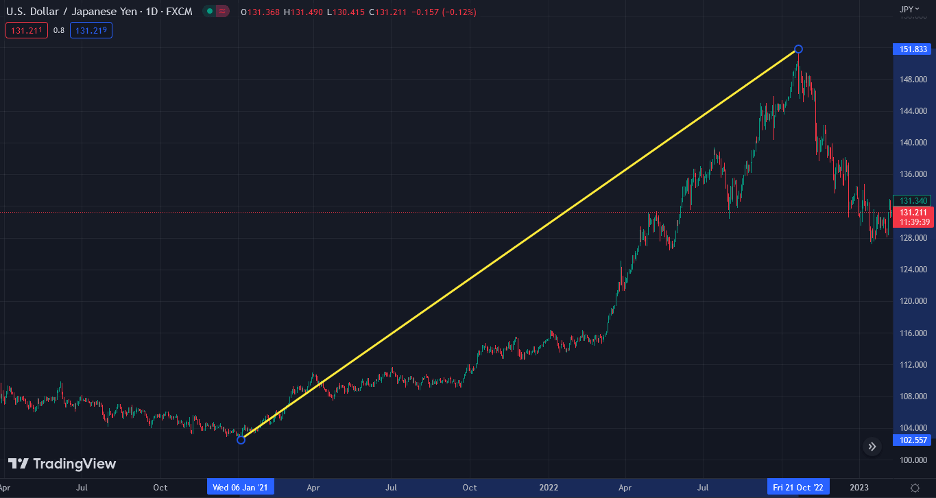

To illustrate how position trading works, let’s look at an example using the USD/JPY currency pair.

In Jan 2021, USD/JPY was trading at around 102.00. If, at that time, you believed that the USD would likely appreciate against the JPY over the long term, you could have taken a long position. Over the following months, the US dollar strengthened significantly versus the Japanese Yen, reaching a high of 151.944 in October 2022. In that case, you would have made significant profits by taking a forex position for over a year and a half.

Forex Position Trading Strategies

In this section, we’ll show you some of the top position trading strategies and how to use them as part of your position trading method.

1. Carry Trade

Carry trade is the most robust forex analysis factor to predict currency pairs’ long-term price movement. In a simple explanation, the carry trade strategy involves borrowing in a low-interest-rate currency and investing in a high-interest-rate currency. The idea is to profit from the interest rate differential between the two currencies. Remember, money has legs and should always be on the move. And that’s why one currency may appreciate or depreciate versus another currency.

For example, you may borrow funds in the Japanese yen, which has historically low interest rates, and buy the Australian dollar, which has higher interest rates. This strategy can be extremely profitable when interest rate differentials are favorable. That’s the idea of carry trade, and most forex position traders make their long-term position trades based on interest rate differential and interest rate hike projections.

2. Trend Trading

As the name implies, trend trading involves identifying a currency pair trending in a particular direction and holding onto the position for an extended period. For instance, if you identify a long-term uptrend in the USD/CAD pair, you may take a long position and hold it for several weeks or months to capture the trend.

For this strategy to work, you have to identify the trend correctly. To do so, you can use technical analysis tools like moving averages, trend lines, Fibonacci support and resistance levels, and classical, harmonic and single candlestick chart patterns. These tools help you determine when a market is trending higher or lower and where potential entry and exit points might be.

3. Range Trading

Another way to position trade is to identify support and resistance levels in the market and take positions within that range. This is known as the range trading strategy.

To apply the range trading strategy, you must look for price patterns indicating the market is trading within a specific range and take positions accordingly. For example, from December 2020 to December 2021, the GBP/USD traded in a sideways-ranging market between 1.3000 and 1.4200. Here, you may take long positions near the support level of 1.3000 and short positions near the resistance level of 1.4200.

Because this range is relatively wide, you will likely hold this position for several weeks or months.

4. 50-Day and 200-Day Moving Average Indicator

Another popular position trading strategy is using a combination of the 50-day and 200-day moving average (MA) technical indicators.

With this trading technique, a trader adds 50 and 200-day MA indicators to a price chart, trying to find trading signals when a crossover occurs between the two MAs. For instance, when the 50-day MA crosses above the 200-day MA, it is interpreted as a bullish signal, and you can, therefore, buy the asset. Conversely, when the 50-day MA crosses below the 200-day MA, it is interpreted as a bearish signal, and you can go short.

The chart below shows that when the yellow 50 MA crosses below the 200 MA, it signals a downtrend.

Is Position Trading the Right Choice for You?

So, now you need to ask yourself if position trading is the right trading style for you. Should it be your go-to strategy in the forex markets?

To start, position trading requires a long-term mindset and patience to hold positions for weeks, months, or even years. Only some people have the right attitude and patience to hold positions for a long time, and you should, therefore, if this strategy matches your personality and preferences. This also means you must withstand market volatility and have a solid risk management plan. To become a profitable position trader, you must understand fundamental analysis and constantly keep up with market news and economic events that may impact your position. Compound trading is also key to success as a position trader.

Additionally, with position trading, you must be willing to weather the storm during market volatility and avoid making emotional decisions. What’s more, to be able to generate high profits in position trading, you must invest a reasonably large sum of money. It is also extremely important to consider that position trading requires locking your capital for a long period, which is certainly one of the main flaws of this strategy. Thus, you must trade with capital you can afford to lock for a while.

On the other hand, unlike other forex strategies, such as scalping or day trading, position trading requires less time and effort daily. This can appeal to those with busy schedules or those who prefer a more laid-back approach to trading.

Furthermore, compared to other trading approaches, position trading involves less trading volume, reducing the costs associated with commissions and spreads. It can also be an excellent way to supplement your income, as it does not require you to become a professional trader or quit your day job.

All in all, despite the disadvantages and risks associated with this type of strategy, position trading is perhaps the most popular and the easiest trading style of all to implement. You analyze the market and then buy (or short-sell) and hold. It is less active than other strategies and, essentially, can be done with little effort.

Money is made by sitting, not trading.

Jesse Lauriston Livermore

Forex Position Trading Strategy – Pros and Cons

Let’s take a closer look at the pros and cons of the forex position trading strategy.

Pros

- Position trading requires less time and effort daily, making it a good fit for those who cannot spend much time on market analysis or those who wish to trade as an extra source of income

- Position traders aim to capture major market movements, which can lead to higher profits over time

- Position trading involves opening a low number of trades, which results in lower trading costs

- Less stress and effort, as position traders typically monitor their positions more passively

Cons

- Requires large amounts of capital to get started and to be able to generate high profits over the long-term

- In position trading, your capital gets locked for a long period of time

- Position traders are exposed to market volatility and may experience severe losses if positions move against them

- Trading positions requires a long-term mindset and patience to hold positions for weeks, months, or even years. This can be challenging if you prefer quick profits

- Many forex brokers that provide a forex trading account charge a swap overnight fee, which ultimately leads to accumulating costs

Frequently Asked Questions (FAQs)

Here are the most frequently asked questions about the position trading strategy:

Is positional trading profitable?

Yes, without a doubt. Positional trading can be profitable if you have a long-term mindset and are willing to hold positions for extended periods.

How can you find currency pairs for position trading?

Unlike short-term forex trading strategies that require traders to focus on currency pairs with high liquidity and a trading volume, in position trading, every currency pair is a good choice. As a matter of fact, most position traders focus on minor and exotic currency pairs that are often more suited for positional trading. The reason is that these currency pairs tend to trend longer than other pairs and, thus, provide significant long-term trends.

Is positional trading suitable for beginners?

Positional trading can be an excellent choice for beginners who prefer a more relaxed and less time-intensive approach to trading. Even more, it is arguably the most straightforward trading style for beginners as it does not require the effort and time required in short-term strategies. Yet, if you are keen to build a career as a trader, then position trading is not necessarily the ideal trading strategy for you to learn the dynamics of the markets. If so, you should engage in a more active trading style and trade actively for a while so you can learn how a financial market asset’s price moves and the main factors you need to consider to build a successful trading routine.

Which timeframe is best for positional trading?

For position trading, it’s best to apply longer time frames such as daily, weekly, and monthly price charts to identify long-term trends. You can also use all-time price charts to gain a broader market perspective.

How can you learn position trading?

If you are interested in learning position trading, plenty of resources are available to help you get started. One of the best ways to learn position trading is to read forex trading books written by experienced forex traders. You can also listen to forex trading podcasts or enroll in online courses that cover the basics of position trading and provide practical tips and strategies. Best of all, you can join our trading academy, where you will learn everything you need to know about trading the markets, including, but not only, the position trading strategy.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.